What Is Best to Do With Life Insurance Payout

What to do with a lump sum life insurance payout. Depending on the size of the life insurance policy payout your options and alternatives could vary widely.

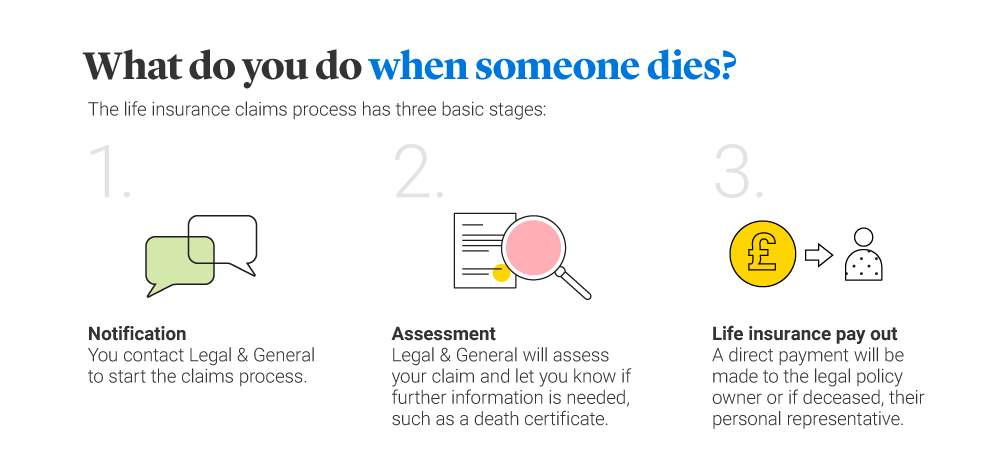

How Do Life Insurance Pay Outs Work Legal General

Keeping a payout in cash will allow you to cover bills and other pressing financial needs in the months after losing a loved one.

. The figures also highlight that in 2019 a total of 34 billion was paid out in UK life insurance claims to help families cope following a bereavement. In 2021 figures from the Association of British Insurers ABI showed the average payout on term life insurance was 79304. Withdrawing funds lowers the death benefit and you will have to cancel or.

3 income tax advantages First move. A life insurance payout will provide much-needed financial support if you lose a spouse or partner. The amount of money and frequency with which you receive it will greatly influence how you spend.

This payment is usually free of income tax and the. In 2021 that amount is 117 million so the good news is that the average person wont have to pay these taxes. Life insurance payouts are generally not counted as income meaning they are not taxable.

When deciding if a 100000 life insurance policy is right for you consider what you want the potential payout to cover. Since the payout is intended primarily for financial relief the first and most obvious destination for the money is toward any lingering bills and debt tied to the claim itself. Youll have to pay estate taxes if the life insurance payout plus the rest of your loved ones estate is worth more than a certain amount.

There are many financial decisions to make including what to do with your life insurance payout. The beginning of determining what is best to do with life insurance payout starts from deciding how to receive life insurance proceeds. If youre a life insurance beneficiary you.

However its not enough to simply dump it into an ETF or mutual fund. Cash value on your policy builds up while youre alive and you can borrow against this amount or withdraw the funds for personal use. In most cases the beneficiaries use at least a portion of the death benefit to pay for funeral expenses if they dont have burial insurance.

If theres anything left over after youve covered those costs you can invest the rest and save for. If you have received a life insurance payout this is one time where it may make sense to let the cash just sit in your account says RJ. And life insurance is one of the best ways to fund a trust.

In many cases insurers pay death benefits within one month. Life insurance is a contractual agreement between a life insurance company and a policyholder hey thats you. The beneficiary receives the full death benefit in one single payment.

The right thing to do with the life insurance death benefit depends on your current expenses including housing bills or childcare. Beneficiaries need to submit a request for benefits. If a portion of the payout is taxable.

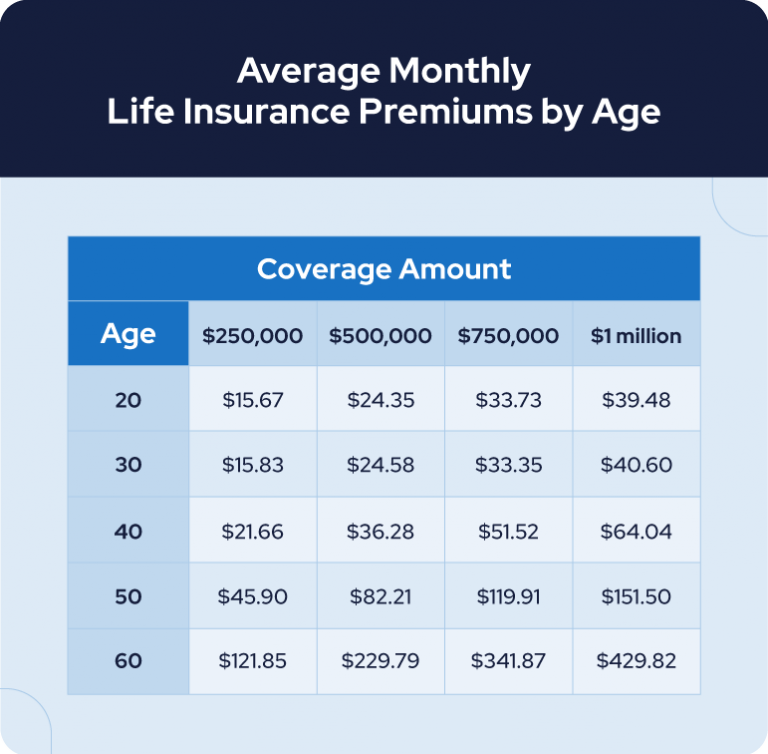

When youre taking out life insurance its important to. In exchange policyholders agree to pay life insurance premiums for the duration of the policy. How much life insurance do I need.

If you receive a life insurance payout the best way to ensure that those proceeds get put to the most appropriate use is to delay any immediate financial decisions said Sullivan. Then the question becomes what to do with lump sum life insurance payout. You are going through the loss of a spouse or.

Calculate Your Life Insurance Coverage Free See How Much You Qualify For. 4 Things to Do With Life Insurance Proceeds Four more things Fish and Uren advise you do. A life insurance payout is paid in a tax-free lump sum or sometimes in installments and can be spent however and whenever you want.

Collecting the death benefit is easiest when beneficiaries have all of the details about life insurance policies. Estate planning is all about ensuring your wishes are. The first thing you should do is hit the pause button he said.

Lets say you receive 250000 tax-free cash from a life. Payouts are not automatic. The amount that you receive is yours to keep and use as you see fit.

Pay off high-interest credit card debt. The best thing to do when you receive a lump-sum life insurance payout is to hold onto that money for several months before making any significant financial decisions. Heres how it works.

Weiss a CFP professional and founder of the personal. The best thing to do when you receive a lump-sum life insurance payout is to hold onto that money for several months before making any significant financial decisions. The best thing to do when you receive a lump-sum life insurance payout is to hold onto that money for several months before making any significant financial decisions.

The beneficiaries can use that money however they wish. Life insurance payouts can provide crucial funding after a loved ones death. Tread carefully when you help clients decide what to do with their life insurance proceeds after a.

Income Taxes on Interest. Likely the policyholder accounted for this in. When you receive life insurance proceeds the best thing to do with it is to invest it and generate more income.

4 Things to Do With Life Insurance Proceeds Four more things Fish and Uren advise you do. In the simplest form of this agreement the insurer pledges to pay a specific amount of money to those named as beneficiaries if the insured dies while the policy is in force. This is the most common form of permanent life insurance which remains intact as long as you live assuming you keep up with the premium payments.

If you have received a life insurance payout this is one time where it may make sense to let the cash just sit in your account says RJ. Pay off high-interest credit card debt. How To Manage Life Insurance Death Benefit Payments.

Instead you should look into robo advisors such as Wealthfront and Betterment. Address any claim-related expenses.

Which Life Insurance Payout Option Should You Choose Forbes Advisor

/179242090-5bfc392646e0fb00265fa90b.jpg)

How Does Life Insurance Work The Process Overview

What Is The Payout Of Two Life Term Insurance Policies 20 Year Term One Purchased In 1938 And 1955

Why Is Life Insurance So Important Fidelity Life

How Life Insurance Works With Wills And Trusts

History Of Life Insurance Infographic Life Insurance Facts Health Insurance Comparison Life Insurance

How Life Insurance Works With Wills And Trusts

How Do Life Insurance Payouts Work In Canada Dundas Life

Best Photo Terrific Pic Health Insurance Benefits Healthinsurance Ideas The M Be Life Insurance Marketing Health Insurance Benefits Life Insurance Facts

How Do Life Insurance Payouts Work In Canada Dundas Life

When Is The Best Time To Buy Life Insurance

How Do Life Insurance Payouts Work Experian

What Is Life Insurance And How Does It Work Money

Facts About Life Insurance Must Know Statistics In 2022 Retireguide

How Does Auto Insurance Payout Work Auto Insurance Quotes Car Insurance Cheap Car Insurance Quotes

What Is Whole Life Insurance Cost Types Faqs

Life Insurance Payout Rates Do Insurers Pay Reassured

What You Need To Know About A Lump Sum Life Insurance Payout Sproutt

Facts About Life Insurance Must Know Statistics In 2022 Retireguide

Comments

Post a Comment